Starting a company in India involves navigating legal, financial, and operational requirements. This guide outlines the step-by-step process to help you establish a business efficiently, as of June 23, 2025.

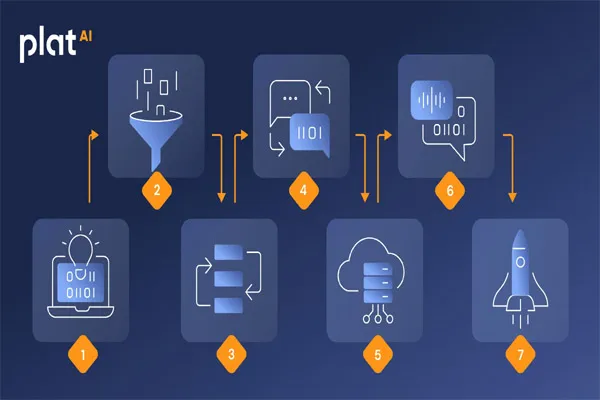

Step 1: Identify Your Business Idea and Structure

-

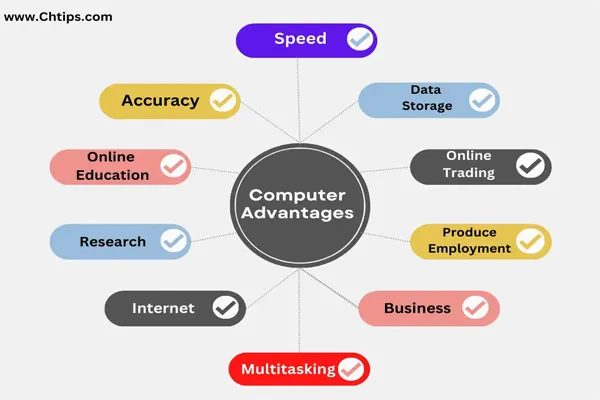

Choose a Business Idea: Validate your idea through market research to ensure demand and feasibility.

-

Select a Business Structure: Common options include:

-

Sole Proprietorship: Ideal for small, low-risk businesses with a single owner.

-

Partnership Firm: Suitable for businesses with multiple owners sharing profits and liabilities.

-

Limited Liability Partnership (LLP): Offers limited liability protection with flexibility.

-

Private Limited Company: Popular for startups due to limited liability, scalability, and investor appeal.

-

One Person Company (OPC): A single-owner company with limited liability.

-

-

Considerations: Choose based on liability, taxation, compliance, and funding needs. Private Limited Companies and LLPs are preferred for startups seeking investment.

Step 2: Create a Business Plan

-

Outline Your Vision: Define your mission, target market, and unique value proposition.

-

Financial Projections: Include startup costs, revenue forecasts, and break-even analysis.

-

Funding Strategy: Decide whether to bootstrap, seek loans, or attract investors.

-

Tools: Use templates from platforms like Bplans or SCORE to structure your plan.

Step 3: Obtain a Digital Signature Certificate (DSC)

-

Purpose: Required for online filing of documents with the Ministry of Corporate Affairs (MCA).

-

Process:

-

Apply through certifying authorities like eMudhra, Sify, or Pantagon Sign.

-

Submit identity and address proof (e.g., Aadhaar, PAN, passport).

-

Receive a USB token with the DSC, valid for 1–3 years.

-

-

Cost: Approximately ₹1,500–₹3,000 per DSC.

-

Note: All directors/partners need DSCs for a Private Limited Company or LLP.

Step 4: Apply for Director Identification Number (DIN)

-

Who Needs It: Directors of a Private Limited Company or OPC.

-

Process:

-

File Form DIR-3 on the MCA portal or apply during company registration via SPICe+.

-

Submit identity proof (PAN/Aadhaar) and address proof.

-

-

Cost: Included in SPICe+ filing or ₹500 for DIR-3.

-

Note: DIN is a unique identifier for directors, valid for life.

Step 5: Reserve Your Company Name

-

Requirements:

-

Name should be unique and not resemble existing trademarks or companies.

-

Include a suffix (e.g., “Pvt Ltd” for Private Limited, “LLP” for Limited Liability Partnership).

-

Avoid prohibited words (e.g., “Government,” “National”) without approval.

-

-

Process:

-

Use the MCA’s RUN (Reserve Unique Name) service or Part A of SPICe+.

-

Submit two proposed names in order of preference.

-

Check availability using the MCA’s name search tool or trademark database.

-

-

Cost: ₹1,000 for RUN or included in SPICe+.

-

Approval Time: 2–3 days.

Step 6: Register Your Company

-

Use SPICe+ Form: A simplified MCA form for company incorporation.

-

Components:

-

Part A: Name reservation (if not done via RUN).

-

Part B: Incorporation, DIN allotment, PAN, TAN, EPFO, ESIC, and GSTIN (optional).

-

-

Documents Required:

-

Identity and address proof of directors/partners (PAN, Aadhaar, voter ID, etc.).

-

Proof of registered office (rental agreement, utility bill, NOC from owner).

-

Memorandum of Association (MoA) and Articles of Association (AoA).

-

DSC of directors and declaration by a professional (CA/CS).

-

-

Process:

-

File SPICe+ on the MCA portal.

-

Pay the registration fee (based on authorized capital).

-

Obtain Certificate of Incorporation (CoI) upon approval.

-

-

Cost: ₹7,000–₹15,000 (including fees and professional charges).

-

Time: 7–15 days.

Step 7: Open a Bank Account

-

Requirement: A current account in the company’s name for business transactions.

-

Documents:

-

Certificate of Incorporation.

-

PAN and TAN of the company.

-

MoA, AoA, and board resolution.

-

Identity and address proof of directors.

-

-

Banks: Choose from SBI, HDFC, ICICI, or fintech platforms like Razorpay for ease.

-

Note: Complete this within 30 days of incorporation to comply with RBI norms.

Step 8: Obtain Necessary Licenses and Registrations

-

Mandatory Registrations:

-

GST Registration: Required if annual turnover exceeds ₹20 lakh (₹10 lakh for northeastern states) or for e-commerce businesses.

-

EPFO and ESIC: Mandatory for businesses with 10+ (ESIC) or 20+ (EPFO) employees.

-

Professional Tax: Varies by state; register within 30 days of hiring employees.

-

-

Industry-Specific Licenses:

-

FSSAI for food businesses.

-

Drug License for pharmaceuticals.

-

Shop and Establishment License for retail/offices (state-specific).

-

-

Process: Apply through respective portals (e.g., GST portal, Shram Suvidha for EPFO/ESIC).

-

Cost: Varies (e.g., GST is free, FSSAI starts at ₹7,500 annually).

Step 9: Comply with Post-Incorporation Requirements

-

Appoint an Auditor: Mandatory for Private Limited Companies/LLPs within 30 days.

-

File Annual Returns:

-

Form AOC-4 (financial statements) and MGT-7 (annual return) for companies.

-

Form 8 and Form 11 for LLPs.

-

-

Maintain Statutory Registers: Record minutes, shareholding, and board resolutions.

-

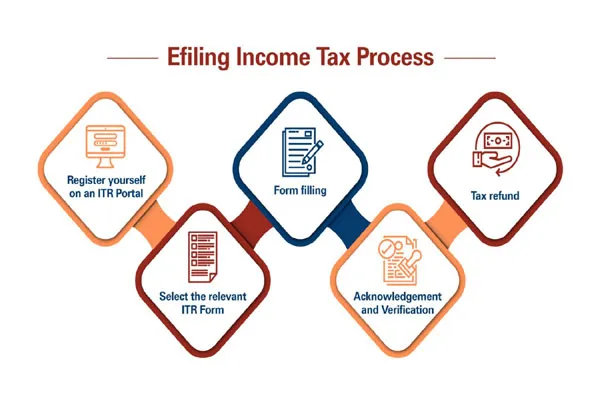

Income Tax Filing: File ITR annually; adhere to TDS and advance tax rules.

-

Note: Non-compliance attracts penalties (e.g., ₹10,000 for delayed filings).

Step 10: Build Your Business

-

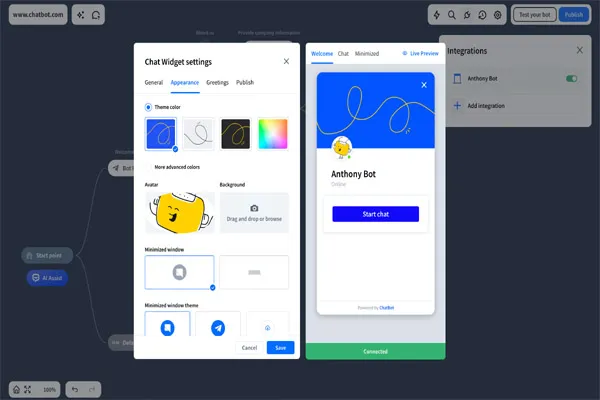

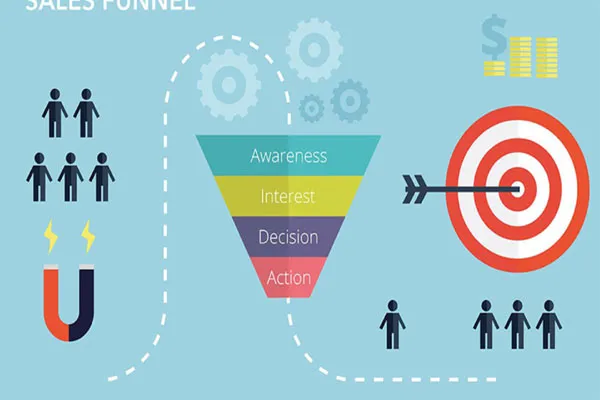

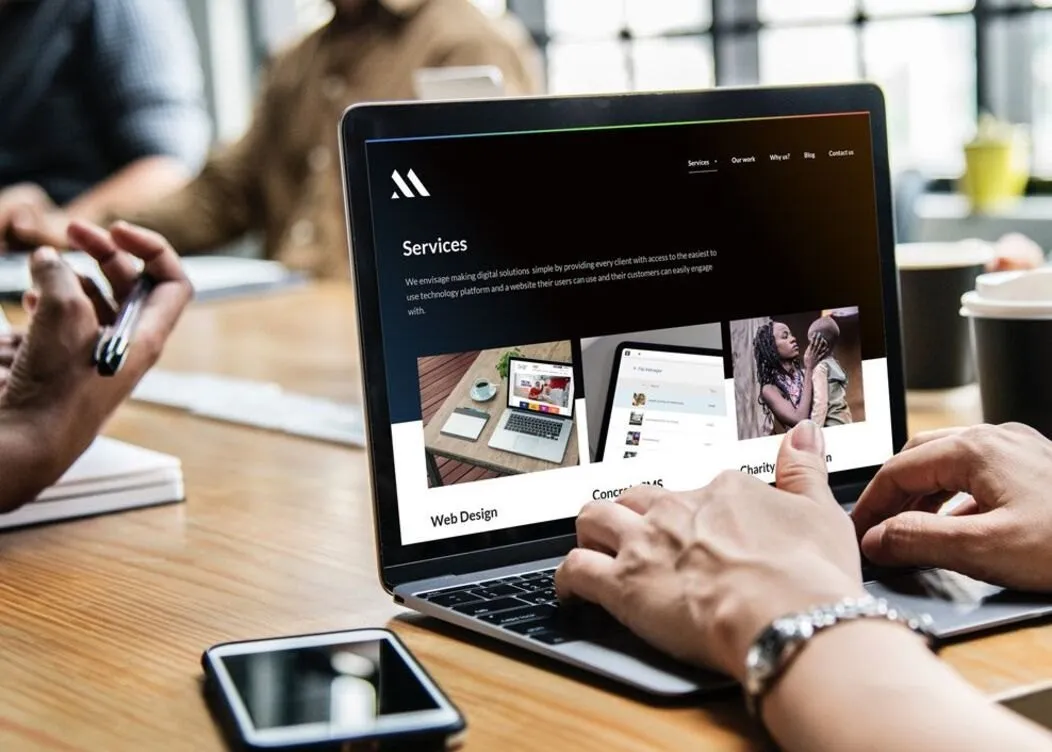

Branding and Marketing: Create a website, logo, and social media presence.

-

Hire Talent: Use platforms like Naukri or LinkedIn; comply with labor laws.

-

Funding Options:

-

Startup India: Register for tax exemptions and funding opportunities.

-

Angel Investors/VCs: Pitch to networks like Indian Angel Network.

-

Loans: Explore MSME loans or schemes like MUDRA.

-

-

Networking: Join industry bodies like FICCI, CII, or startup incubators.