-

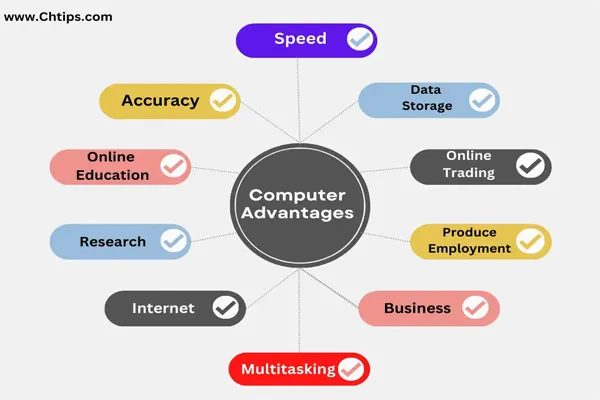

Robust Infrastructure: India's banking system has a well-developed infrastructure with a wide network of branches, ATMs, and online platforms, making banking services accessible to a large population.

-

Financial Inclusion: The Indian government and banks have focused on improving financial inclusion through schemes like Jan Dhan Yojana, which has led to millions of previously unbanked individuals gaining access to banking services.

-

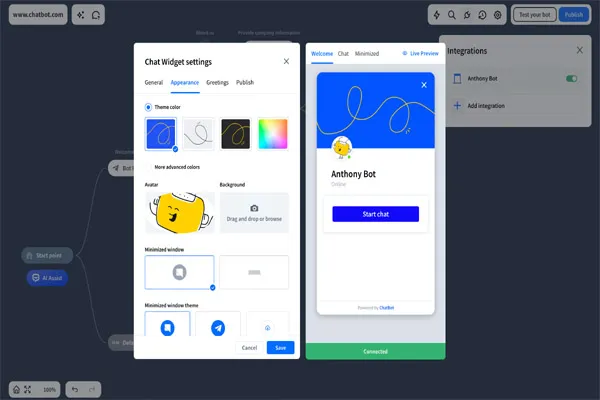

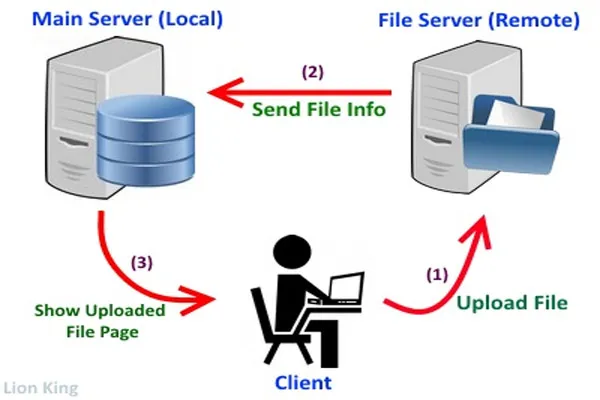

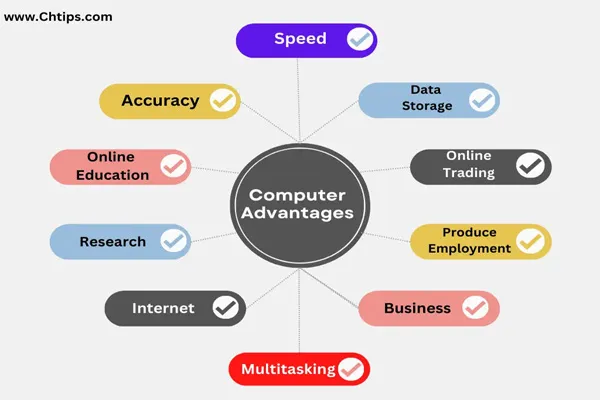

Digital Transformation: The introduction of internet banking, mobile banking apps, and automated teller machines (ATMs) has made banking more efficient and accessible, reducing the need for physical visits to branches.

-

Regulatory Oversight: The Reserve Bank of India (RBI) plays a pivotal role in maintaining the stability and security of the banking system. Strict regulatory measures ensure that banks operate transparently and safeguard depositor interests.

-

Growth in Credit and Savings: Indian banks have made significant progress in expanding credit facilities to various sectors, including agriculture, SMEs, and retail, contributing to economic growth. The system also encourages savings with attractive interest rates on deposits.

-

Government Schemes and Subsidies: Numerous government initiatives, like the Pradhan Mantri Awas Yojana, PMGDISHA, and Mudra loans, have made financial products more accessible to underserved sections of society, thus promoting socio-economic development.

-

Diverse Banking Products: Indian banks offer a variety of financial products and services, including loans, insurance, mutual funds, and pension plans, catering to different customer needs.

-

Instant and Real-Time Transactions: UPI enables seamless, immediate money transfers 24/7, ensuring that payments are made and received in real time. This is especially useful for businesses and individuals who need quick settlement of transactions.

-

Low Transaction Costs: UPI transactions incur minimal or no charges, making it an affordable option for users. This is a significant advantage over traditional banking methods that involve higher transaction fees.

-

Ease of Use: The UPI system is user-friendly, with a simple interface for making payments using mobile phones. Users can transfer money, pay bills, and make purchases with just a few taps, making it convenient for tech-savvy and non-tech-savvy users alike.

-

Interoperability: UPI allows users to link multiple bank accounts to a single platform and facilitates easy peer-to-peer transactions, regardless of the banks involved. This interoperability simplifies payments across different financial institutions.

-

Increased Digital Payments Adoption: UPI has contributed significantly to the growth of digital payments in India. Its adoption by various sectors, including e-commerce, utilities, and even offline retailers, has enhanced the shift towards a cashless economy.

-

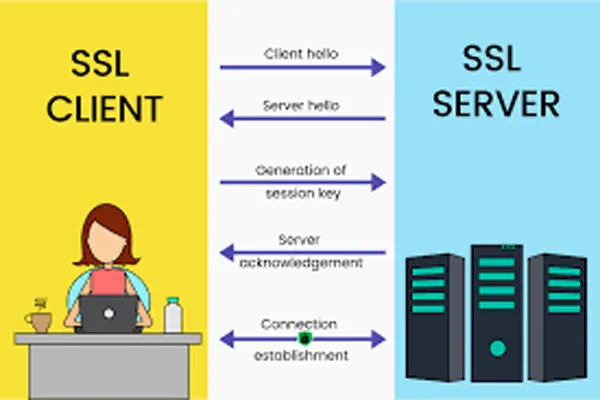

Security: UPI uses two-factor authentication, which provides a secure environment for conducting transactions. In addition, it employs encryption and other advanced security measures to ensure that user data and money are protected.

-

Integration with Various Platforms: UPI has been integrated with various apps and platforms, allowing users to link it to their mobile wallets, bill payment services, and even shopping platforms. This integration facilitates quick, easy, and secure transactions across diverse sectors.

-

Government and Bill Payment Services: UPI allows users to easily pay government taxes, fees, and utility bills through different platforms, offering a streamlined and efficient way to handle everyday payments.

-

Financial Inclusion: UPI plays a crucial role in enhancing financial inclusion, especially for people in rural areas, by offering easy access to digital payment services through basic smartphones and mobile apps.

Advantage of Indian Banking system and UPI

-

Robust Infrastructure: India's banking system has a well-developed infrastructure with a wide network of branches, ATMs, and online platforms, making banking services accessible to a large population.

-

Financial Inclusion: The Indian government and banks have focused on improving financial inclusion through schemes like Jan Dhan Yojana, which has led to millions of previously unbanked individuals gaining access to banking services.

-

Digital Transformation: The introduction of internet banking, mobile banking apps, and automated teller machines (ATMs) has made banking more efficient and accessible, reducing the need for physical visits to branches.

-

Regulatory Oversight: The Reserve Bank of India (RBI) plays a pivotal role in maintaining the stability and security of the banking system. Strict regulatory measures ensure that banks operate transparently and safeguard depositor interests.

-

Growth in Credit and Savings: Indian banks have made significant progress in expanding credit facilities to various sectors, including agriculture, SMEs, and retail, contributing to economic growth. The system also encourages savings with attractive interest rates on deposits.

-

Government Schemes and Subsidies: Numerous government initiatives, like the Pradhan Mantri Awas Yojana, PMGDISHA, and Mudra loans, have made financial products more accessible to underserved sections of society, thus promoting socio-economic development.

-

Diverse Banking Products: Indian banks offer a variety of financial products and services, including loans, insurance, mutual funds, and pension plans, catering to different customer needs.

-

Instant and Real-Time Transactions: UPI enables seamless, immediate money transfers 24/7, ensuring that payments are made and received in real time. This is especially useful for businesses and individuals who need quick settlement of transactions.

-

Low Transaction Costs: UPI transactions incur minimal or no charges, making it an affordable option for users. This is a significant advantage over traditional banking methods that involve higher transaction fees.

-

Ease of Use: The UPI system is user-friendly, with a simple interface for making payments using mobile phones. Users can transfer money, pay bills, and make purchases with just a few taps, making it convenient for tech-savvy and non-tech-savvy users alike.

-

Interoperability: UPI allows users to link multiple bank accounts to a single platform and facilitates easy peer-to-peer transactions, regardless of the banks involved. This interoperability simplifies payments across different financial institutions.

-

Increased Digital Payments Adoption: UPI has contributed significantly to the growth of digital payments in India. Its adoption by various sectors, including e-commerce, utilities, and even offline retailers, has enhanced the shift towards a cashless economy.

-

Security: UPI uses two-factor authentication, which provides a secure environment for conducting transactions. In addition, it employs encryption and other advanced security measures to ensure that user data and money are protected.

-

Integration with Various Platforms: UPI has been integrated with various apps and platforms, allowing users to link it to their mobile wallets, bill payment services, and even shopping platforms. This integration facilitates quick, easy, and secure transactions across diverse sectors.

-

Government and Bill Payment Services: UPI allows users to easily pay government taxes, fees, and utility bills through different platforms, offering a streamlined and efficient way to handle everyday payments.

-

Financial Inclusion: UPI plays a crucial role in enhancing financial inclusion, especially for people in rural areas, by offering easy access to digital payment services through basic smartphones and mobile apps.