Selling online offers immense opportunities for reaching a wider audience and growing your business. However, navigating the regulations, especially around the Goods and Services Tax (GST), can be challenging. Here's a comprehensive guide on how to sell online without GST.

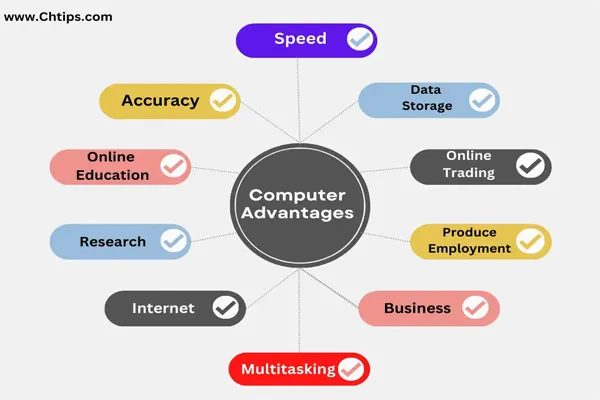

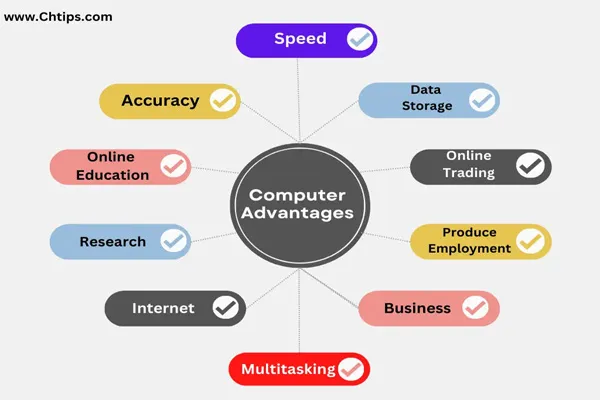

1. Understand GST Basics

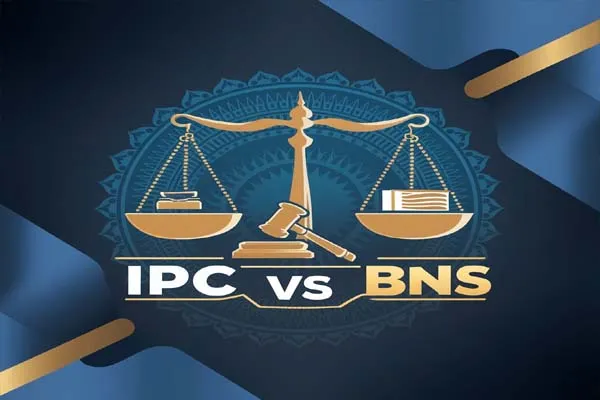

Before diving into how to sell without GST, it's crucial to understand what GST is and its applicability:

- GST: Goods and Services Tax is an indirect tax levied on the supply of goods and services in India.

- Threshold Limit: Businesses with an annual turnover below ₹40 lakhs (₹20 lakhs for special category states) are exempt from GST registration. For service providers, the threshold is ₹20 lakhs (₹10 lakhs for special category states).

2. Evaluate Your Business

Assess whether your business falls below the GST threshold limit:

- Turnover Calculation: Calculate your annual turnover to see if it’s below the prescribed limits. Include all sales, whether online or offline.

- Nature of Goods/Services: Certain goods and services might be exempt from GST. Check if your products fall under this category.

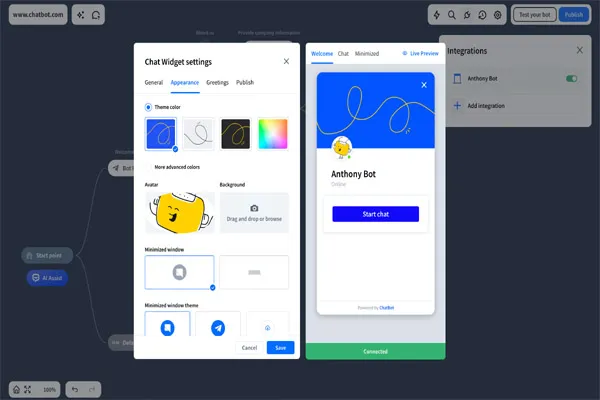

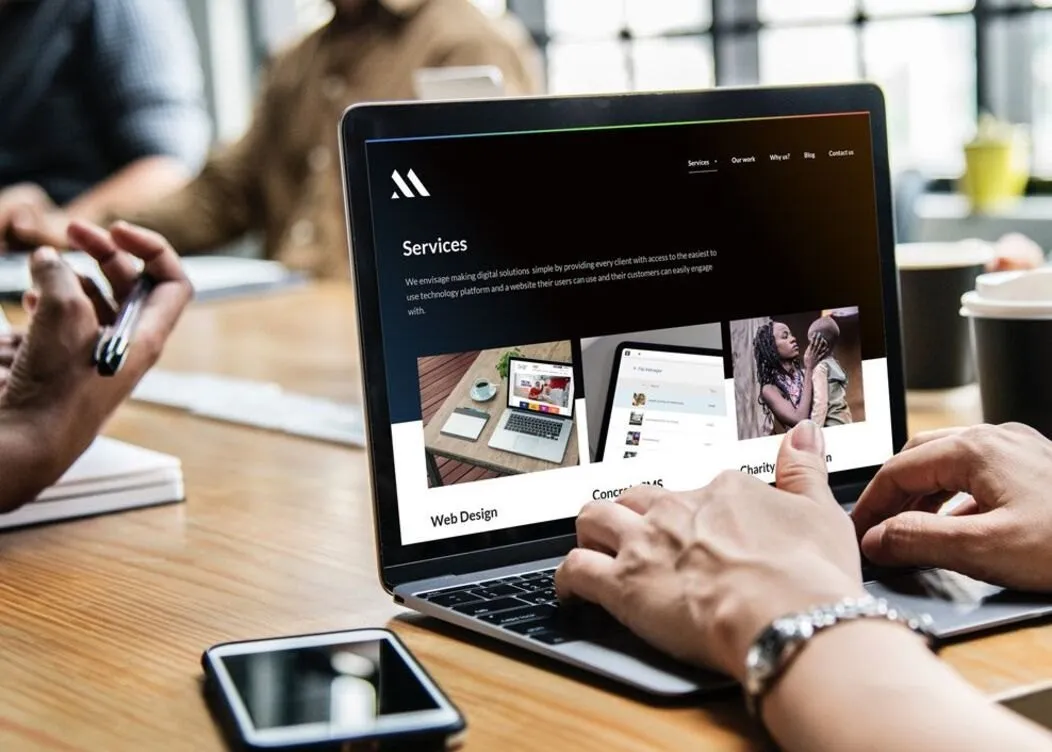

3. Choose the Right Online Marketplace

Some online marketplaces may require GST registration, but many support small sellers who do not have GST:

- Platforms Supporting Non-GST Sellers:

- Facebook Marketplace: Ideal for local selling without the need for GST registration.

- Instagram: Allows selling directly through posts and stories.

- Etsy: Suitable for handmade and unique items, often with relaxed GST requirements.

- Local Selling Apps: Apps like OLX and Quikr allow selling without GST.

4. Register Your Business Appropriately

Even if you’re exempt from GST, you may still need to register your business under other applicable laws:

- Shop and Establishment Act: Most states require businesses to register under this act.

- MSME Registration: Beneficial for small and medium enterprises to avail various government benefits.

5. Invoice Management

Even without GST, maintaining proper invoicing is crucial:

- Non-GST Invoice: Clearly state "Non-GST" on your invoices.

- Record Keeping: Keep detailed records of all transactions for compliance and accounting purposes.

6. Leverage Social Media and Personal Networks

Utilize social media platforms and personal networks to promote your products:

- Social Media Marketing: Use platforms like Facebook, Instagram, and Twitter to showcase your products.

- WhatsApp Business: Create a catalog and share it with your contacts.

7. Explore Offline Payment Options

Using offline payment methods can help in maintaining a GST-free status:

- Cash on Delivery (COD): Many customers prefer this method, and it helps in avoiding online transaction tracking.

- UPI and Bank Transfers: Simple and straightforward methods for receiving payments.

8. Seek Professional Advice

Consult a tax professional or legal advisor to ensure you comply with all relevant laws and regulations:

- Tax Consultant: Can help you understand the nuances of GST and other tax implications.

- Legal Advice: Ensures that your business adheres to all necessary legal requirements.

9. Stay Updated

Regulations can change, so stay informed about the latest updates in tax laws:

- Government Websites: Regularly check official portals for updates.

- Newsletters and Blogs: Subscribe to industry newsletters and blogs for the latest information.

Conclusion

Selling online without GST is feasible if your business operates below the threshold limits and adheres to all other relevant regulations. By choosing the right platforms, maintaining proper documentation, and leveraging social media, you can successfully run your online business without GST registration. Always seek professional advice to navigate the complexities and stay compliant with the evolving regulatory landscape.