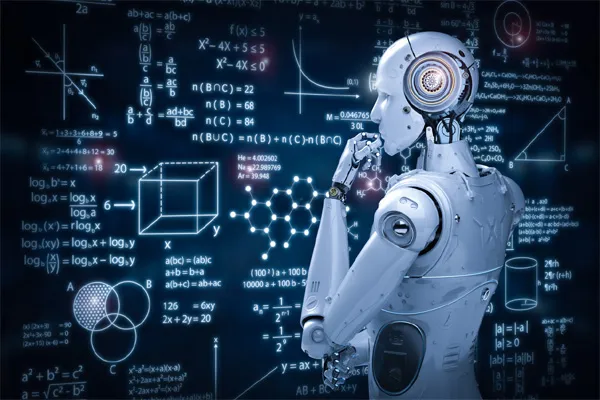

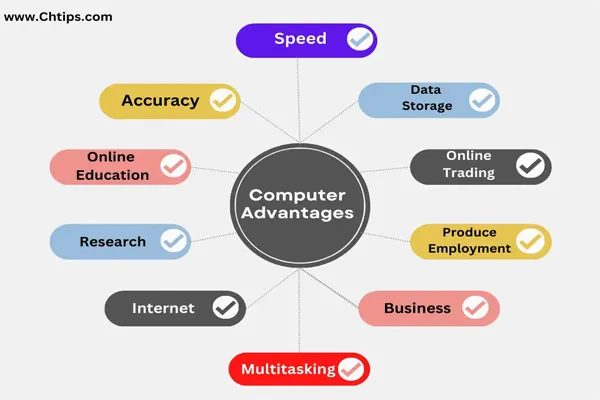

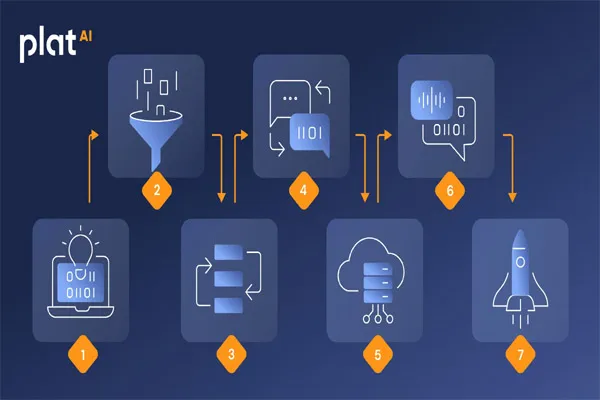

1. Enhanced Decision-Making

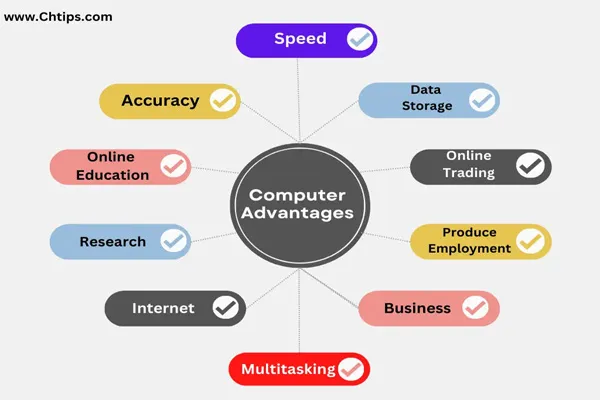

AI systems analyze vast amounts of data at lightning speed, identifying patterns and trends that might be invisible to human traders. This helps make data-driven decisions with higher accuracy and consistency.

2. Faster Execution of Trades

AI-powered trading platforms can execute trades within milliseconds. This speed is essential in markets where even small delays can lead to missed opportunities or financial losses.

3. Reduced Emotional Bias

Unlike human traders, AI systems are not influenced by emotions like fear or greed. This leads to more rational decision-making, which can help avoid impulsive decisions that may result in losses.

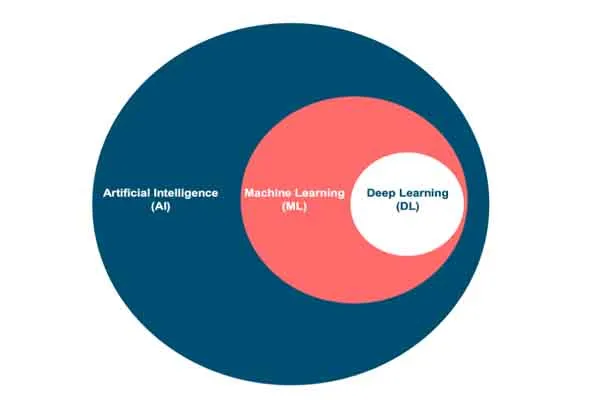

4. Predictive Analytics

AI utilizes machine learning algorithms to predict market trends and movements based on historical data, allowing traders to anticipate changes and adjust their strategies proactively.

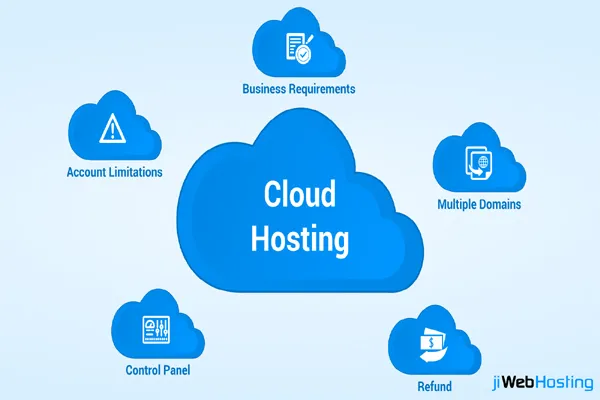

5. 24/7 Market Monitoring

AI systems can continuously monitor markets and execute trades round the clock without the need for breaks or sleep. This is especially valuable in global markets that operate across different time zones.

6. Risk Management

AI can analyze potential risks and calculate the optimal levels of exposure for traders. By assessing historical trends and volatility, AI can help minimize risk while maximizing potential returns.

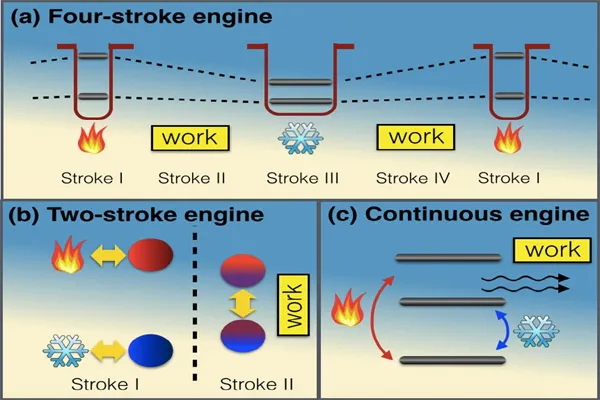

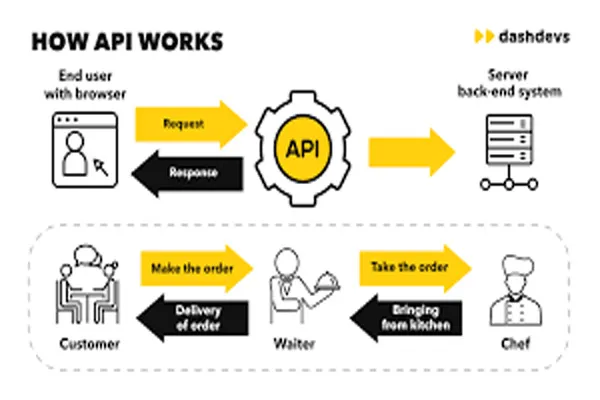

7. Algorithmic Trading

AI enables the use of complex algorithms that can analyze and execute trades based on predefined criteria, improving trading efficiency and scalability. This includes high-frequency trading (HFT) strategies, where trades occur at a much higher speed than humanly possible.

8. Portfolio Optimization

AI algorithms can help investors optimize their portfolios by continuously assessing the best allocation of assets based on risk tolerance, expected returns, and other factors. This leads to better diversification and long-term growth potential.

9. Backtesting and Strategy Refinement

AI can perform backtesting on historical data to evaluate the effectiveness of trading strategies. By refining and optimizing strategies based on real-time performance, AI enhances trading outcomes and reduces the risk of costly mistakes.

10. Market Sentiment Analysis

AI can process and analyze news, social media, and other textual data to assess market sentiment. This allows traders to gain insights into public opinion, geopolitical factors, or economic events that could influence asset prices.

11. Reduced Human Error

AI systems operate based on well-defined algorithms, reducing the likelihood of mistakes caused by human oversight or fatigue. This leads to more reliable and efficient trading operations.

12. Cost Efficiency

AI-driven trading systems can replace the need for large teams of human analysts, reducing operational costs for trading firms while maintaining performance and scalability.