ATMs (Automated Teller Machines) work as electronic banking kiosks that allow users to perform various financial transactions without needing a bank teller. Here’s a basic overview of how they function:

1. User Identification

Card Insertion: Users insert their bank cards, which contain a magnetic strip or chip that holds account information.

PIN Entry: Users enter a Personal Identification Number (PIN) to verify their identity.

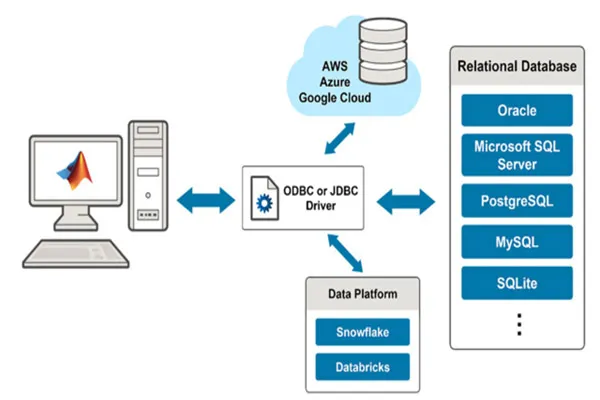

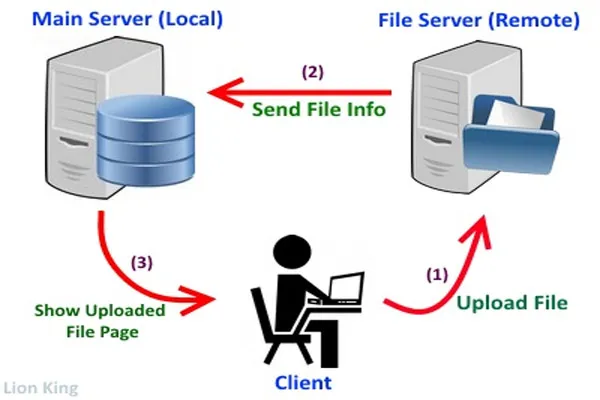

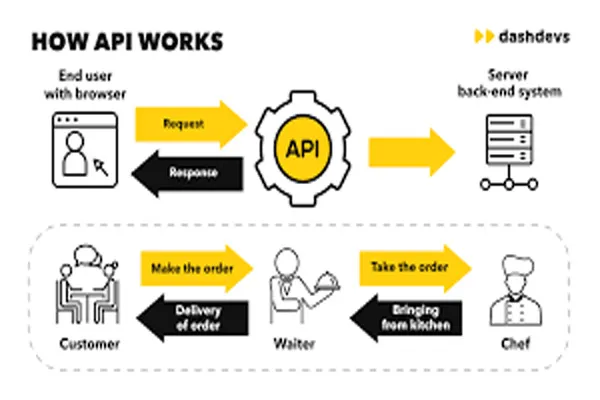

2. Communication with the Bank

The ATM communicates with the bank's central system through a secure network. This could be via telephone lines, internet, or other data connections.

3. Transaction Selection

After authentication, users can choose from various options (e.g., cash withdrawal, balance inquiry, fund transfer).

4. Transaction Processing

The ATM sends a request to the bank’s server to process the selected transaction. The server checks the user’s account for sufficient funds and verifies other details.

5. Dispensing Cash or Completing Transactions

If the transaction is approved:

Cash Withdrawal: The ATM dispenses the requested amount of cash using a series of mechanisms that release bills from a cash cassettes.

Account Updates: The bank updates the user’s account balance in real time.

6. Receipt Printing (if requested)

Users can request a printed receipt, which is generated by the ATM.

7. Ending the Session

After the transaction is complete, the ATM ejects the card, and the session ends, ensuring security and user privacy.

8. Maintenance and Security

ATMs are regularly maintained to ensure they are functioning properly and securely. They have security features like encryption and fraud detection to protect users.

In summary, ATMs streamline banking by allowing users to access their accounts and perform transactions quickly and securely.